10 Different Types of Debit Card Processing Fees

What are debit card processing fees?

Debit card processing fees refer to the fees charged by payment processors, banks, and card companies (Visa, Mastercard, etc.) when a customer pays with a debit card.

These fees typically include the following:

- monthly processing fees

- interchange fees

- assessments

- processor’s markup fees

These fees may vary depending on the size of the bank that issued the card, the type of business, whether a PIN or signature is used, and whether the bank holds more or less than $10 billion in assets.

How much is a debit card processing fee?

The average debit card processing fee is 0.65% of the transaction amount or an average of 23 cents.

Factors such as the merchant category, the type of transaction, and the size of the financial institution issuing the card can all influence the fee.

Regulated banks are capped at 0.05% plus 21 cents, while unregulated banks have variable interchange fees.

Researching to find the exact rates for your specific situation is important.

The different types of fees related to debit card processing

Debit card processing is a vital part of running a business, but understanding its various fees can be confusing.

Let’s discuss all the elements that affect the total fee of a debit card processing transaction.

1. Merchants’ transaction fee

The transaction fee for debit card processing is the cost associated with each transaction.

For B2C merchants, the fee is typically a flat rate plus a percentage of the transaction amount.

For B2B merchants, the fee is typically a higher percentage of the transaction amount.

The Durbin Amendment sets the rate cap for debit card processing at 0.05%, with a transaction fee of either $0.21 or $0.22 if a fraud adjustment applies.

If the issuing bank holds $10 billion or more in assets, the rate is the maximum allowed by law.

The rate may be lower if the issuing bank has less than $10 billion in assets.

2. Network fee

A network fee is a charge imposed by debit networks such as NYCE, STAR and ACCEL to route transaction information among businesses and banks.

The fee consists of a percentage, a flat transaction fee, a switch fee, and an annual fee.

It can vary depending on the merchant category code, transaction size, and other variables.

For example, unregulated PIN debit network fees may have a maximum fee cap, while many have no cap.

Network fees are important for processing debit cards because they help cover the routing information cost, ensuring the payment system runs smoothly.

Additionally, the fees help maintain the system’s security, as debit networks are responsible for verifying and authenticating transactions.

Without these fees, merchants shouldered the cost of processing payments entirely, and the expense would likely be passed on to consumers in the form of higher prices.

3. Interchange fee

Interchange fees are the fees charged by card issuers (usually banks) for each transaction processed using a debit card.

These fees are based on the card payment networks’ charges and can vary from transaction to transaction.

Interchange fees are typically a percentage of the transaction amount, usually around 1.5%.

Regulated banks (those with over $10 billion in assets) have a maximum interchange rate of 0.05% plus 21 cents. In comparison, unregulated banks or financial institutions (those with less than $10 billion in assets) have variable interchange rates depending on various factors, such as the size of the transaction and the merchant category code.

In addition to the interchange fees, merchants may incur processing services fees charged by their payment processor.

These fees are separate from the interchange fees and are used to cover the cost of processing payments.

4. Payment processor fees

Payment processor fees for debit card processing can vary depending on the payment processor’s pricing model, the type of card used, and the total number of transactions processed monthly.

The most common pricing models are interchange-plus, flat rate, subscription, and tiered.

Most processors charge a flat rate plus a percentage of the transaction for debit card processing, with fees ranging from 1.15% + $0.05 to 3.15% + $0.10 in interchange fees plus an additional 0.14% to 0.17% in assessment fees.

Popular payment processors such as Dharma Merchant Services, Helcim, Square, and Stripe typically charge interchange-plus or flat-rate fees, with Dharma Merchant Services offering interchange plus 0.15% + 8 cents per in-person transaction, interchange-plus 0.20% + 11 cents per online transaction, and 0.5% plus 25 cents for ACH payments.

Square charges 2.6% plus 10 cents for in-person transactions, 2.9% plus 30 cents for online transactions or invoices without a card on file, and 3.5% plus 15 cents for manually keyed transactions.

Meanwhile, Stripe charges 2.9% plus 30 cents for online transactions, 2.7% plus 5 cents for in-person transactions, 3.4% plus 30 cents for manually keyed transactions, and 3.9% plus 30 cents for international cards or currency conversion.

Additionally, most payment processors will charge a markup fee, usually a flat rate per transaction plus a percentage of the transaction amount.

These markup fees can range from around 2.9% + to $.30.

5. Bank fees

Bank fees related to debit card processing include the following:

- 0.05% transaction fee plus $0.21 or $0.22 if a fraud adjustment is applied

- variable interchange fees for unregulated debit transactions from banks with less than $10 billion in assets

- monthly service fees for debit card users

- ATM fees for withdrawing from competitor banks

- overdraft fees for spending more than the balance in one’s account

The Durbin Amendment of the 2010 Dodd-Frank legislation regulates these fees for banks with more than $10 billion in assets, limiting the transaction fee to 0.05% plus $0.21.

Consumers can avoid some of these fees by keeping a minimum balance in their checking accounts, avoiding ATMs that charge service fees, and not over-drafting their accounts.

6. Fraud prevention costs

Fraud prevention costs for debit card processing refer to the additional fees associated with preventing fraudulent activity on debit cards.

These fees are imposed by banks and card networks like Visa and Mastercard to help protect retailers and consumers from fraudulent transactions.

The Federal Reserve regulates the fees that the nation’s largest banks can charge, capping them at 21 cents per transaction plus 0.05% of the transaction amount.

Smaller banks are exempt from this regulation and may charge higher fees.

These fees can add up quickly and significantly reduce a business’s profit margins, so retailers should carefully consider the costs associated with debit card processing before signing any contracts.

7. Credit card swipe fees

A credit card surcharge is the fee associated with debit card processing.

These fees are typically a percentage of each transaction and can vary based on the type of card and the bank size.

For example, the fees for credit cards from the nation’s largest banks are capped by the Federal Reserve at 21 cents per transaction plus 0.05% of the transaction amount, while cards from small banks are exempt.

Fees for debit cards average about 2% of the transaction but can be as high as 4% for some premium rewards cards.

These fees cost retailers and their customers more than $160 billion annually.

8. Pin debit fees

PIN debit fees are the fees associated with processing PIN debit transactions, which are debit card purchases verified with a customer’s personal identification number (PIN).

These fees are distinct from the interchange fees charged by credit card networks for transactions.

PIN debit fees are important to consider when evaluating debit card fees because they can significantly impact a business’s bottom line.

Generally, PIN debit transactions have lower percentage fees and lower interchange fees than credit card transactions.

However, the fixed fee per transaction can be high, so small-ticket transactions are typically more expensive.

This means that, depending on the size of the average transaction, a business may pay processing fees for PIN debit transactions than signature debit transactions.

Therefore, it’s important to weigh the cost of each type of transaction and to understand how much of an impact PIN debit fees can have when evaluating debit card processing fees.

9. Merchant account services

When using debit card processing through a merchant account, various fees are associated with the services.

These include the following:

- Merchant Service Charges (MSC)

- Payment Gateway Fees

- Authorization Fees

- PCI Compliance Fees

- Chargeback Fees

- Card-not-Present Fees

The exact rate of each fee will vary depending on the card network used, the merchant’s acquirer and the payment method.

MSCs are transaction fees typically charged as a percentage of each sale, while Payment Gateway Fees might be charged at a flat monthly rate or per transaction.

Authorization Fees cover the cost of card authorization, PCI Compliance Fees cover an important security feature, and Chargeback Fees are costs incurred when a transaction is reversed.

Finally, Card-not-Present Fees apply to card-not-present transactions.

10. Other charges

Other charges related to debit card processing include interchange fees, assessment fees, and monthly service charges.

Interchange fees are non-negotiable fees charged for each transaction involving a debit card.

These fees are paid to the payment network and are often referred to as the base cost or the discount rate.

Assessment fees are charged by the payment network and are based on the type of transaction and the merchant’s sales volume.

Monthly service charges are typically a flat fee that the merchant pays the payment network, covering services such as customer support and fraud protection.

Depending on the merchant’s location, there may also be surcharges or convenience fees applied to debit card purchases.

Surcharges are a percentage of the total purchase cost, while convenience fees are fixed debit card charges.

Merchants in states that prohibit surcharges must post a notice at their store entrance, and sales receipts must itemize the surcharge amount.

For online purchases, merchants must disclose the surcharge on the website where credit cards are first mentioned.

How to find and choose the best deal for your business?

Finding the best deal for your business can greatly impact your bottom line.

You can save time and money with the right provider and payment options.

Researching and weighing the pros and cons before committing to a payment processor is important.

Factors such as transaction fees, set-up fees, bulk discounts, and flexible pricing should be considered when deciding on the best option.

You should also look closely at the fine print and avoid high-risk transactions.

By shopping around, you can ensure you get the best deal and the greatest savings.

Step 1: Identify the type of transaction you’re doing

It is important to identify the type of debit card transaction you are doing because it can significantly impact the fees you will be charged.

Signature debit transactions are processed via credit card networks, while PIN debit transactions are processed via debit networks, and the fees associated with each type vary.

Identifying the type of transaction you are doing allows you to accurately estimate the cost of processing a transaction, which can help you decide the most cost-effective option for your business.

Step 2: Research and compare per-transactions rates

It is important to research and compare per-transactions rates when selecting a credit and debit card processor because the fees associated with the transactions can greatly impact your bottom line.

Different providers will charge different fees, so it is important to shop around to find the best rate with the lowest fees.

Additionally, additional fees for early termination, monthly transaction volumes, or point-of-sale fees may be associated with certain processors.

By researching and comparing per-transaction rates, you can ensure that you get the best rate for your business and minimise the impact of transaction fees on your bottom line.

Step 3: Look into hardware and software bundles

When choosing a cloud computing provider, it is important to look into hardware and software bundles because these cost considerations can greatly impact your typical monthly expenses.

Debit card processing may require additional hardware, such as a point-of-sale terminal, and software, such as wireless access apps, to process payments.

The cost of these items can vary depending on the payment processor and the type of card processing solution you select.

Additionally, service fees for processing may be calculated based on the type of transactions you process.

Therefore, it is important to research and compares the cost of different provider bundles before deciding.

With the right provider, you can access 24/7 live support, reporting and analytics, advanced risk and fraud monitoring, dispute management tools, and payment gateway access.

These features can add up to significant cost savings in the long run.

Step 4: Consider the needs of your business customers

One of the best ways to find and choose the best deal for your business when it comes to accepting payments is by considering the needs of your business customers. Here is a step-by-step guide for how to do this:

- Research the different payment options available. Consider which payment methods are most popular with your customers and what fees each charge.

- Calculate the fees you would pay for each option. Consider both the per-transaction rate and any applicable monthly service fees.

- Consider any costs associated with the software, apps, or wireless access if using a POS device.

- Consider the long-term benefits of accepting multiple forms of payment. Even if the fees associated with certain forms of payment might cost you a few of your profits, the benefit of happy customers can go a long way.

- Make a decision based on both your research and your budget. Make sure to balance the costs with the benefits of having more payment options available to your customers.

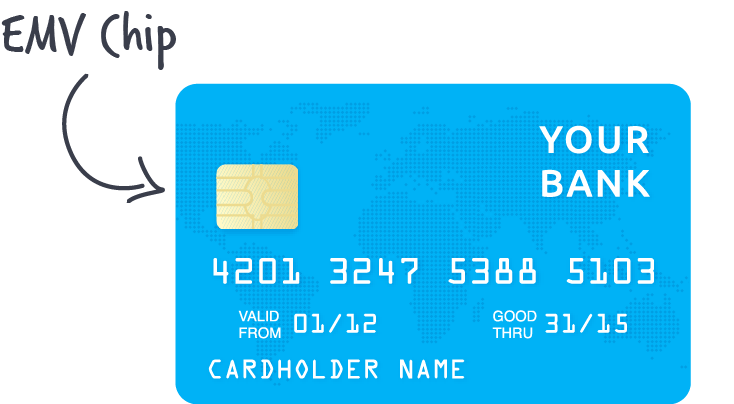

Step 5: Learn about EMV cards, PIN authentication, and chip-and-PIN cards

Learning about EMV cards, PIN authentication, and chip-and-PIN cards is important because they are widely used in the payments industry today.

EMV cards are secure cards embedded with microchip technology, while PIN authentication is used to identify the cardholder and verify their identity.

Chip-and-PIN cards are similar to EMV cards in that they also have a microchip and require the customer to enter their PIN for authentication.

PIN debit transactions are processed through debit networks, such as Interlink or Maestro, and the fees charged for these transactions vary depending on several factors.

Moreover, customers can opt for PIN or signature debit when making a purchase, and the fees associated with each method vary.

Because of this, understanding these payment technologies and their associated fees is key to making the best financial decisions and maximizing profits for businesses.

Step 6: Read reviews and evaluate value for money

Reading reviews and evaluating value for money are important when making financial decisions because it allows one to make an informed decision.

By reading reviews and getting expert opinions, one can better understand the product or service they are considering.

Additionally, by evaluating the value for money, one can save money by choosing an option that works best for them in terms of quality and cost.

Step 7: Determine how compliant your card processor is with PCI standards

It is important to determine how compliant your card processor is with PCI standards to ensure your customers’ credit card information is secure.

PCI stands for the Payment Card Industry Data Security Standard and is a set of requirements designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment.

Payment processors must adhere to these standards to be compliant.

If your processor is not compliant, you could face hefty fines, increased transaction fees, or have your service provider terminated.

Furthermore, customers may feel unsafe using your payment processor and opt to use another one instead, which can result in lost sales and revenue.

Therefore, it is important to ensure your card processor complies with PCI standards to protect your customers’ data and ensure they feel safe doing business with you.

Step 8: Check if the card processor has support for Apple Pay or Android Pay

It is important to check if the card processor supports Apple Pay or Android Pay because contactless and mobile wallet payments are becoming increasingly popular.

By offering customers the ability to pay with Apple Pay and Android Pay, you can provide them with a more convenient and secure way to make purchases.

Additionally, supporting these mobile payment options may attract more customers who prefer to use them.

Ultimately, offering these payment options can help to increase your customer base and boost your bottom line.

Step 9: Ask about refund policies if there’s a problem with the service

When considering accepting debit card payments, you should ask about the following:

- The per-transaction rate

- Any applicable point-of-sale (POS) device costs

- Any monthly service fees

- Advanced risk and fraud monitoring

- Tools to help you manage disputes

- Reporting and analytics

- 24/7 live support

- Payment gateway access (if you choose e-commerce payment processing)

- The refund policies in case of a problem with the service.

Step 10: Make sure the card processing service is secure for your business

Accepting debit card payments is essential for any business.

Not only does it offer convenience to customers, but it also increases sales and boosts your bottom line.

However, ensuring your card processing service is secure for your business is important.

Choosing the right provider and having the proper security measures are essential for keeping customer data safe and protecting your business from fraud.

- Smart Tax: How to Use Smart Tax Calculator and Federal Income Tax Calculator - December 5, 2023

- Collateralization: 5 FACTS you should know about collateralization - May 1, 2023

- A Comprehensive Guide to Forensic Accounting: Definition, services, and more - December 15, 2022