Collateralization: 5 FACTS you should know about collateralization

What is collateralization?

Collateralization is using a valuable asset as collateral to secure a loan.

In this type of loan arrangement, the borrower pledges an asset to the lender, and in case of a loan default, the lender has the right to take possession of the asset and sell it to recover the loan’s outstanding balance.

Collateralization reduces the risk for lenders and can help borrowers with poor credit histories obtain loans at a lower interest rate than unsecured loans.

How does collateralization work?

Here’s a simple explanation of how collateralization works:

- The borrower offers an asset as collateral to secure the loan from the lender. The asset is usually of equivalent or higher value than the loan amount.

- The lender assesses the loan-to-value ratio of the collateral, which is the loan amount ratio to the collateral’s total value.

- If the loan-to-value ratio is satisfactory, the lender will approve the loan and release the funds to the borrower.

- The borrower agrees to pay the loan amount and the interest at the agreed time.

- If the borrower cannot repay the loan per the terms, the lender can take control of the collateral and sell it to recoup the outstanding balance.

What does it mean to be fully collateralized?

Being fully collateralized means that the borrower has provided enough assets to the lender to cover the full amount of the loan.

In other words, the assets the borrower offers are equal to or greater than the loan amount.

This offers the lender a sense of security against the risk of loan default, as the lender is confident they can recover their money if the borrower defaults.

What does over-collateralized mean?

Over-collateralization is when a borrower pledges more collateral than is required to secure a loan.

It is a risk mitigation technique where lenders can be assured of repayment even if a borrower defaults.

This technique benefits borrowers with poor credit histories as it helps them access financing.

However, it increases the debt against an asset, and if the borrower defaults, the lender can seize the collateral and sell it off to recover the loan.

What is the difference between collateralization and securitization?

Collateralization is the process of offering assets as collateral for a loan. It is a mechanism for securing a loan using valuable assets to guarantee payment.

Compared to securitization, which transforms illiquid assets into saleable securities using financial engineering, collateralization is simpler and easier to recover if the loan defaults.

There are two parties involved in collateralization – the borrower and the lender.

The lender is invested in a single asset or borrower; thus, the agreement between them is relatively uncomplicated.

In contrast, securitization involves a trust which creates the securities, and a lender is invested in a diversified portfolio of assets. Therefore, the agreement becomes complex.

5 helpful facts about collateralization

To help you better understand collateralization.

1. Collateralization is the process of using assets as security or security for a loan

Collateralization is the use of a valuable asset as collateral to secure a loan.

The borrower provides the asset to guarantee the loan, and if the borrower fails to repay the loan, the lender can take possession of the asset and sell it to cover the loss.

This reduces the overall default risk, making it easier for borrowers with poor credit histories to obtain loans.

A collateralized loan is considered to be secured loans and generally have much lower interest rates than unsecured loans.

Collateralization also provides lenders greater security against default on loans, as they can seize and sell the asset if the borrower fails to repay their loan.

2. Interest rates for collateralized vs unsecured loans

Collateralized loans: these are lones generally available at a lower interest rate than unsecured loans because the lender assumes a lower risk in case of default.

For example, as of May 2022, auto loans for applicants with a good credit rating can be obtained at an average interest rate of 4.68%, and a 30-year fixed-rate mortgage could be obtained at an average interest rate of 5.54%.

The median interest rate across all credit cards in the Investopedia card database was 19.62%. Interest rates for personal loans, which can be either collateralized or unsecured, ranged from 3% to 36%.

In many cases, banks are reluctant to lend unsecured loans to borrowers despite their excellent credit ratings due to the fear of losing the entire loan amount if the borrower default.

Thus, the banks prefer to lend money to those borrowers who can offer adequate collateral cover.

3. Collateralized business loans

Collateralized business loans require the borrower to offer up assets as collateral to the lender to reduce the lender’s risk in case of a default on loan.

These are samples of assets that can be collateralized:

- cash

- investments

- inventory

- real estate

Collateralized business loans differ from traditional unsecured loans because the latter does not require the borrower to provide collateral.

Additionally, collateralized business loans are used for different purposes than traditional loans, such as funding expansion projects or purchasing large equipment.

Furthermore, collateralized business loans typically have lower interest rates than unsecured loans because of the reduced risk for the lender.

Lastly, unlike margin loans, collateralized business loans may not be used to purchase securities and typically have higher advance ratios.

4. Collateralization can be used to secure loans and credit facilities against fluctuations in asset prices

Collateralization can be used to secure loans and credit facilities against fluctuations in asset prices by using the value of certain assets as collateral against a loan.

Banks and financial institutions will assess the maximum loan-to-value ratio before releasing the loan and setting the interest rate.

To utilize collateralized loans to secure against fluctuations in asset prices, investors should first contact a brokerage firm to inquire about margin trading and the amount of margin they are allowed.

The margin allowed is typically a multiple of the value of the securities held in the investor’s account.

After the margin has been agreed upon, the investor will sign a loan agreement that outlines the loan terms, including the interest rate and length of the loan.

Once the loan agreement is finalized, the investor’s securities are used to secure the loan.

The investor’s securities will be released from the collateralization agreement when the loan is paid off.

If the borrower defaults on the loan, the lender may seize and sell the collateral asset to cover their losses.

5. Collateralized investing: Buying on a margin

Collateralized investing involves using a borrower’s assets as security to receive a loan from a lender.

This type of investing is frequently used when buying on a margin, an investment strategy allowing an investor to purchase securities primarily with borrowed money.

When an investor buys on a margin, they must make a deposit that is a fraction of the total amount borrowed.

This deposit is the collateral, allowing the lender to ensure that they can recoup their money even in the event of default by the borrower.

The collateral is typically equal to a percentage of the total loan. For instance, if an investor borrows $1,000, the brokerage may require a collateral deposit of 25% or $250.

The investor then uses the borrowed money to purchase securities, hoping to make a profit.

If the investment proves successful, the loan is repaid with the profits made from the purchase.

The broker will issue a margin call if the investment does not deliver the expected returns.

Doing so requires the investor to either deposit additional money or securities or sell some of the assets to bring the account up to the minimum value.

Therefore, collateralized investing with buying on a margin is a way investors can leverage their existing assets to increase their potential gains while also protecting themselves from potential losses.

Examples of collateralization

We’re providing you with an informative list of assets that can be used in a collateralized loan.

1. Mortgage loan collateralization

Mortgage loan collateralization provides a secured loan where the borrower offers an asset as collateral to secure the loan.

Collateral is an asset that a lender can seize and sell to pay off a loan in the event of a default by the borrower. In the case of a mortgage loan, the asset is usually real estate property.

Examples of collateralization include using real estate property to secure a loan.

Using securities as collateral when borrowing money for margin trading and offering the same house as collateral for more than one mortgage.

2. Collateralized equity pledge

A collateralized equity pledge is a legal agreement that stipulates that a company pledges its stock or equity as collateral for a loan or debt obligation.

This pledge assures creditors that the debt will be repaid, as the collateral will be liquidated in the event of default.

For example, let us assume that a company has issued bonds worth $500,000 and has pledged its equity as collateral for these bonds.

If the company cannot repay the bonds, the equity can be liquidated to cover the debt.

3. Collateralized bond

A collateralized bond is a type of corporate debt security in which the issuer (the borrowing company) pledges its assets, such as equipment and property, as collateral against the repayment of the bond to the investors.

This provides additional security to the investors, who can take possession of the collateral should the borrower fail to meet its obligations and default on the bond repayment.

In comparison, a standard bond does not involve any form of collateral to secure debt repayment.

Instead, investors rely on the issuer’s creditworthiness and ability to repay the bond.

As a result, collateralized bonds tend to have lower interest rates than standard bonds.

4. Collateralization of securities

An example of collateralization of securities is when an investor obtains a loan to invest in margin trading and provides securities as collateral to the lender.

For example, if John borrows $5,000 for margin trading, and the brokerage charges 20% of the loan as collateral, then John must offer securities worth $1,000 (20% * $5,000) as collateral.

John must earn enough profit from the investments to cover the loan’s interest rate.

5. Personal property collateralization

An example of personal property collateralization is when a lender requests a borrower to put up specific items of personal property, such as jewelry, as collateral for a loan.

For instance, let’s say a borrower needs a loan of $3,000 and offers to use their jewelry as collateral.

The lender can then appraise the jewelry to determine how much of the loan amount they are willing to lend.

Typically, the lender will approve a loan amount that is 70-90% of the appraised value of the jewelry.

If the borrower defaults on loan payments, the lender can seize the jewelry.

6. Collateralization in the finance industry

Collateralization is a financial mechanism of using valuable assets to secure a loan.

This provides a sense of security to the lender against the risk of loan default while helping the borrower get loans at competitive interest rates.

In the event of a loan default by the borrower, the lender may confiscate the collateral and sell it off to repay the loan or at least cover the loss.

Collateral-backed loans are usually available at a substantially lower interest rate than unsecured loans.

7. Collateralization of collateral

We’re providing step-by-step instructions on how to collateralize collateral.

- The borrower identifies the assets they will use as collateral to secure the loan.

- The lender evaluates the assets and assigns a loan-to-value (LTV) ratio. This ratio determines the maximum loan amount the borrower can borrow.

- The lender reviews the borrower’s credit score and other financial information to determine their creditworthiness.

- If approved, the lender will issue the loan, and the borrower must deposit the collateral in an escrow account.

- The borrower will make regular payments on the loan, and the collateral will be released once the loan is fully repaid.

- If the borrower defaults on the loan, the lender will take possession of the collateral and sell it to recover their losses.

8. Drug development collateralization

A drug development example of collateralization is when a pharmaceutical company uses its assets as collateral for a loan to fund its drug research and development activities.

For instance, a pharmaceutical company may use its intellectual property, such as patents and trademarks, as collateral to secure a loan from a bank.

The collateral provided would then be used to cover the costs of drug research, including staff salaries, equipment, and materials needed to create the drug.

If the company cannot pay back the loan, the bank would have the right to liquidate the collateral.

9. Agricultural product collateralization

An example of agricultural product collateralization is when a farmer takes out a loan and uses the expected harvest of a crop as collateral.

For example, a farmer may take out a loan to purchase equipment and use the expected harvest of a crop as collateral.

If the farmer fails to repay the loan, the lender can take possession of the crop to cover their losses.

This collateralization benefits both the lender and the farmer, allowing the farmer to access the funds they need to improve their operations without liquidating other assets.

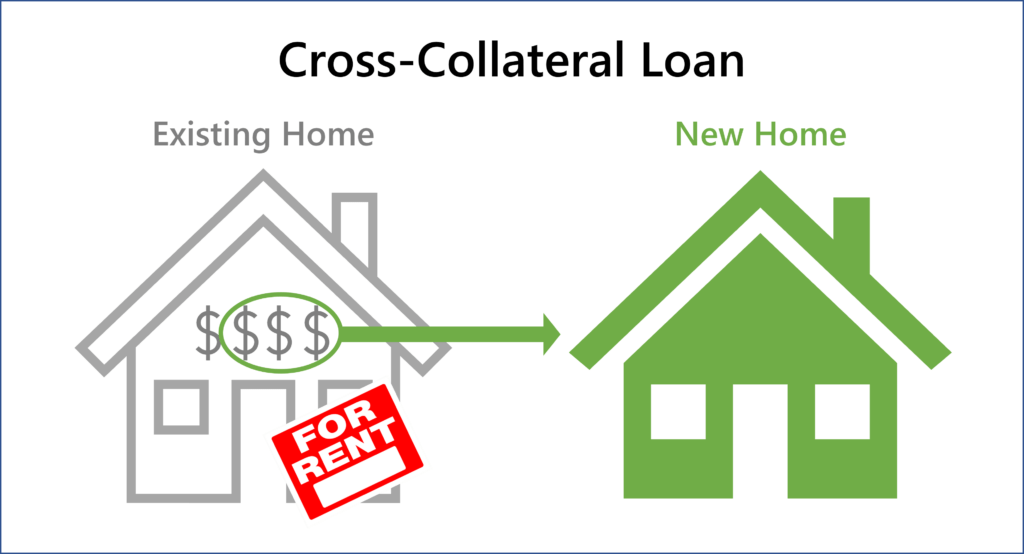

What is cross collateralization?

Cross collateralization is a financing technique in which a borrower pledges the same asset to secure multiple loans.

This involves a cross-default provision, meaning that if the borrower defaults on one loan, all loans that use the same collateral are also in default.

Cross collateralization can reduce the risk for the lender and make the borrower more attractive for financing.

It is predominantly used for retail or commercial loans and typically involves tangible assets that have equity, such as real estate, cars, and other equipment.

How does cross collateralization work?

Cross collateralization is a financing technique when a borrower pledges the same collateral to secure multiple loans.

Here is a step-by-step guide on how it works:

- Decide on the type of collateral you wish to use. This could be business assets, personal assets, or a combination of the two.

- Agree with the lender regarding the loan collateral. The lender will disclose if you are asked to pledge or re-pledge an asset as collateral.

- The lender will use the same piece of collateral to secure multiple loans and add a cross-default provision. If you default on one of the loans, you also default on all loans that use the same asset as collateral.

- Until all loans are paid off in full, you cannot claim full ownership over the collateral. For example, if the bank used your car as cross collateral for a personal loan, you would still be unable to sell it until you pay it off.

- Once all the loans are paid off, you will regain full ownership of the collateral.

- Smart Tax: How to Use Smart Tax Calculator and Federal Income Tax Calculator - December 5, 2023

- Collateralization: 5 FACTS you should know about collateralization - May 1, 2023

- A Comprehensive Guide to Forensic Accounting: Definition, services, and more - December 15, 2022